What is the Exness Forex Calculator?

The Exness Forex Calculator is a free tool for traders to crunch numbers fast. It takes the headache out of calculating things like pip values, margins, or swap fees. You just plug in your trade details, and it spits out the results. I’ve used it for years, and it’s a lifesaver when you’re planning trades. Instead of guessing, you get clear numbers to work with. It’s built for forex, but it also handles crypto, stocks, and commodities. No need for a calculator or spreadsheets—just a few clicks.

This tool pulls real-time market data to give you estimates. It’s not perfect, since markets move fast, but it’s close enough to plan properly. Think of it as your trading assistant, helping you avoid costly mistakes. For example, I once avoided a bad trade because the calculator showed I’d need way more margin than I had.

Key Components of the Calculator

The Exness Forex Calculator has a few core pieces that make it work. Each one tackles a different part of your trade. Here’s what you get:

- Profit and Loss: Shows how much you could make or lose based on your entry and exit prices. It factors in trade size and currency pair.

- Margin: Tells you how much cash you need to open a position. This is huge for managing leverage.

- Pip Value: Calculates what one pip movement is worth in your account’s currency. Super useful for risk control.

- Swap Fees: Estimates the cost of holding a trade overnight, both for buy and sell positions.

- Spread Cost: Gives you the cost of the spread when you open a trade, based on the previous day’s average.

Each component uses near real-time data, so you’re not working with outdated numbers. I like how it covers everything in one place. No jumping between tools. It’s all there, whether you’re trading EUR/USD or gold.etup.

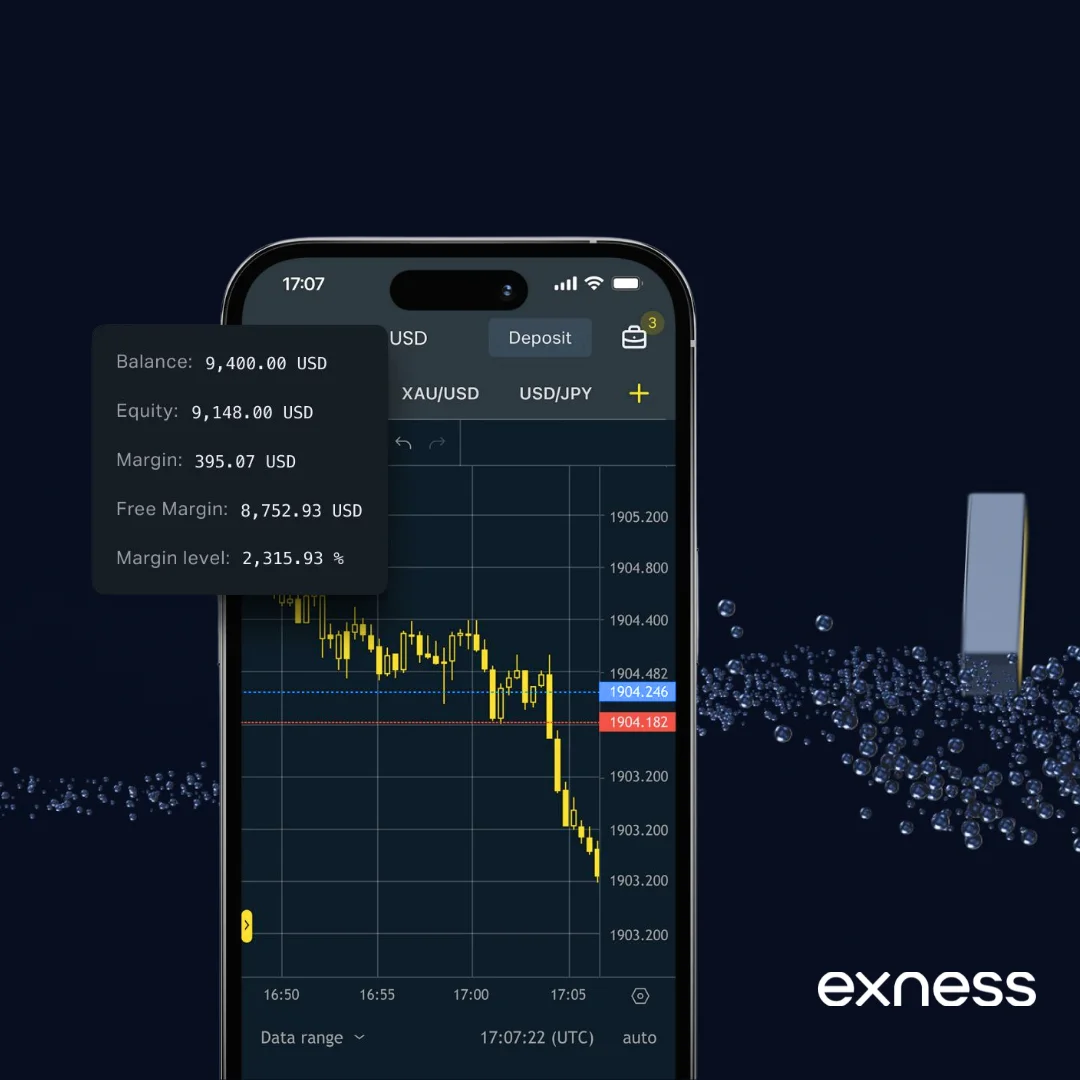

Chart Analysis on Mobile

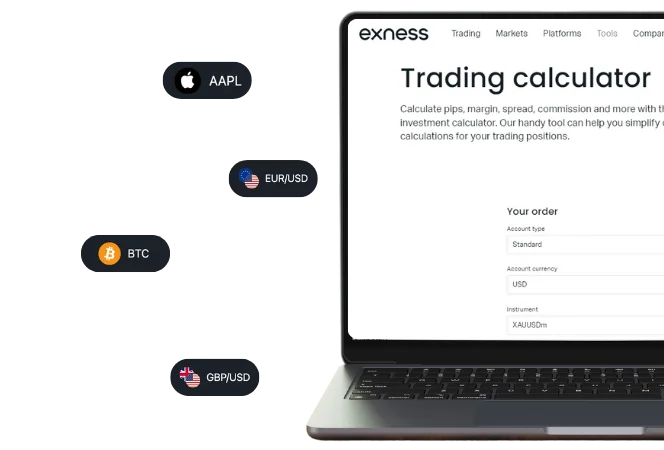

How to Use the Exness Forex Calculator

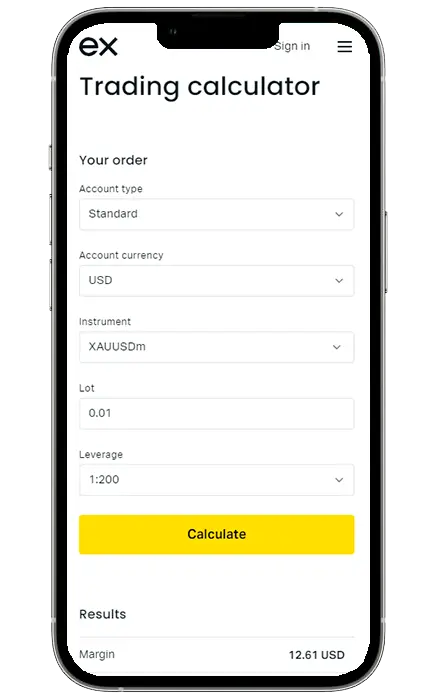

Using the Exness Forex Calculator is dead simple. You don’t need to be a math whiz. Here’s how I do it:

- Go to the Exness website and find the “Tools” section.

- Pick your account type (like Standard or Pro).

- Choose your trading instrument (say, GBP/USD or Bitcoin).

- Enter your trade size in lots.

- Set your leverage (like 1:100 or 1:500).

- Add your entry and exit prices if you’re calculating profit.

- Hit “Calculate” and check the results.

The whole thing takes maybe 30 seconds. I usually run it before every trade to double-check my numbers. It’s like having a quick chat with a trading buddy who’s good at math.nnection is best for scalping or high-volatility sessions.

Benefits of Using the Exness Forex Calculator

This calculator isn’t just a shiny toy—it’s a game-changer. First, it saves time. Instead of crunching numbers manually, you get instant results. That means more time analyzing the market. It also helps with risk management. By showing you margin requirements and pip values, you can avoid over-leveraging or blowing your account.

Another big win is clarity. You see exactly what a trade might cost, from spreads to swaps. I’ve dodged bad trades because the calculator showed high swap fees for holding overnight. Plus, it’s free for all Exness users, and it works on any device. Whether you’re a beginner or a seasoned trader, it makes your life easier.

Practical Applications in Trading

Let’s get real about how this tool fits into your trading. Say you’re eyeing a trade on EUR/USD with a $1,000 account. You’re thinking 1 lot with 1:200 leverage. Plug those into the calculator. It’ll show you need about $590 in margin and that each pip is worth $10. If the pair moves 20 pips in your favor, you’re up $200. But if it goes against you, you’re down the same. This helps you set a stop-loss that fits your risk.

Or maybe you’re trading gold (XAU/USD). You want to hold it overnight. The calculator shows the swap fee for a buy position is $5 per lot. That’s critical if you’re planning a long-term trade—it adds up. I use it to test different scenarios, like tweaking lot sizes or leverage, to find the sweet spot for my strategy.

Here’s a quick table I put together for a recent trade setup I tested:

| Instrument | Lot Size | Leverage | Margin Required | Pip Value | Swap Fee (Overnight) |

| EUR/USD | 1.0 | 1:200 | $590 | $10 | $0.80 |

| XAU/USD | 0.5 | 1:100 | $945 | $0.50 | $5.00 |

This kind of breakdown keeps your trades grounded in reality, not hope.

Forex Trading with Low & Stable Spreads

Trade global forex with low spreads and superior conditions for better results, maximizing your potential with each trade.

Frequently Asked Questions

What is the Exness Calculator Forex used for?

It calculates key trade metrics like profit, loss, margin, pip value, and swap fees to help you plan and manage risk effectively.

Can the Exness Calculator Forex be used for all currency pairs?

Yes, it works for all forex pairs Exness offers, plus other assets like crypto, stocks, and commodities.

Does the Exness Calculator Forex account for different account types?

Absolutely, it adjusts calculations based on your account type, like Standard, Pro, or Zero, for accurate results.

How accurate is the Exness Calculator Forex?

It’s very accurate using real-time data, but spreads and swaps can vary when you actually trade due to market conditions.

Can I use the Exness Calculator Forex on mobile devices?

Yes, it’s fully accessible on phones or tablets through the Exness website or app, making it easy to use anywhere.